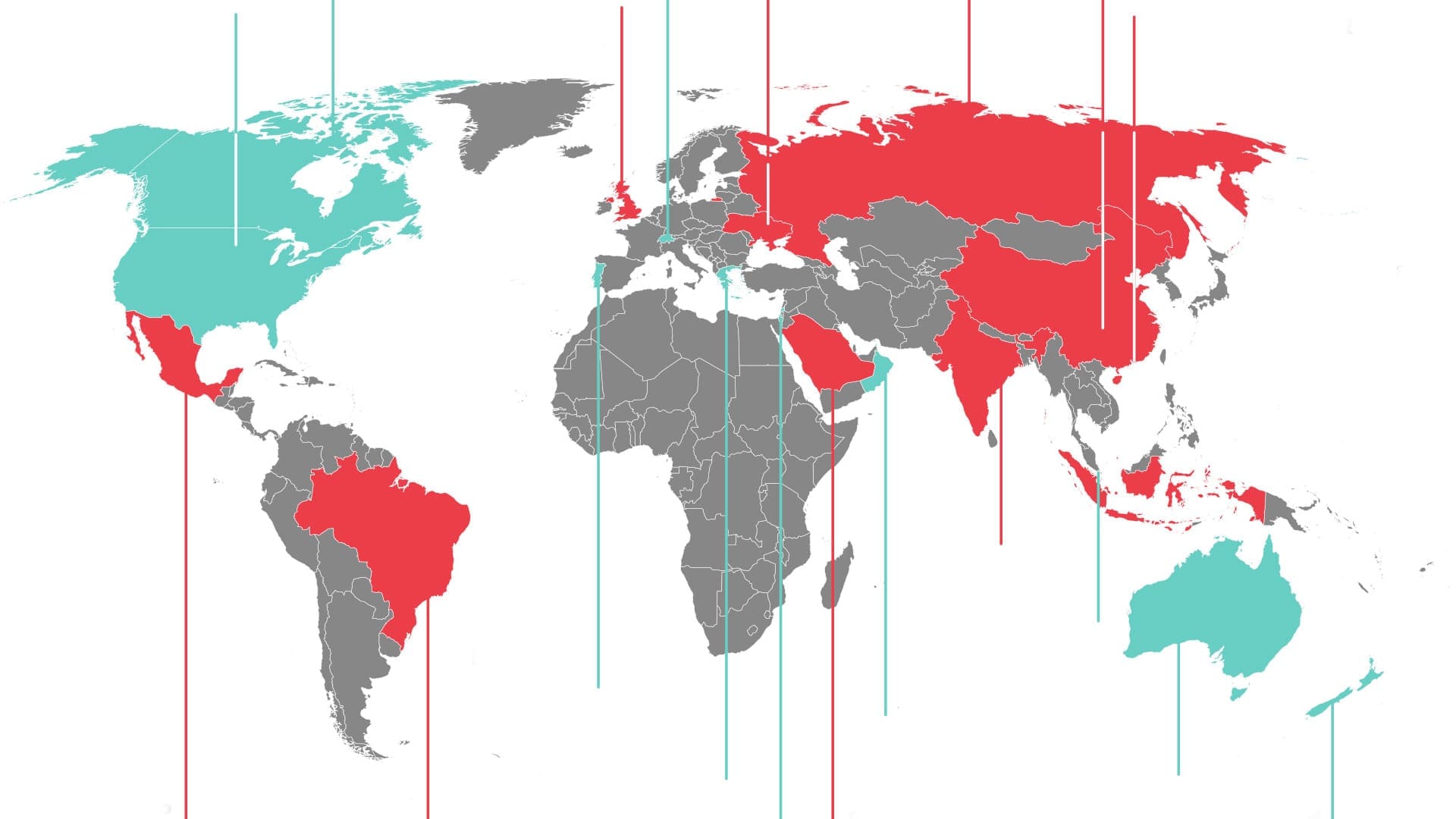

This is Where the Rich are Leaving and Going

The above graphic maps the projected flows of High net worth individuals (HNWI) across 2022. In this case, A high net worth individual is someone worth US$1 Million plus. So I guess anyone who’s recently sold a home in New Zealand.

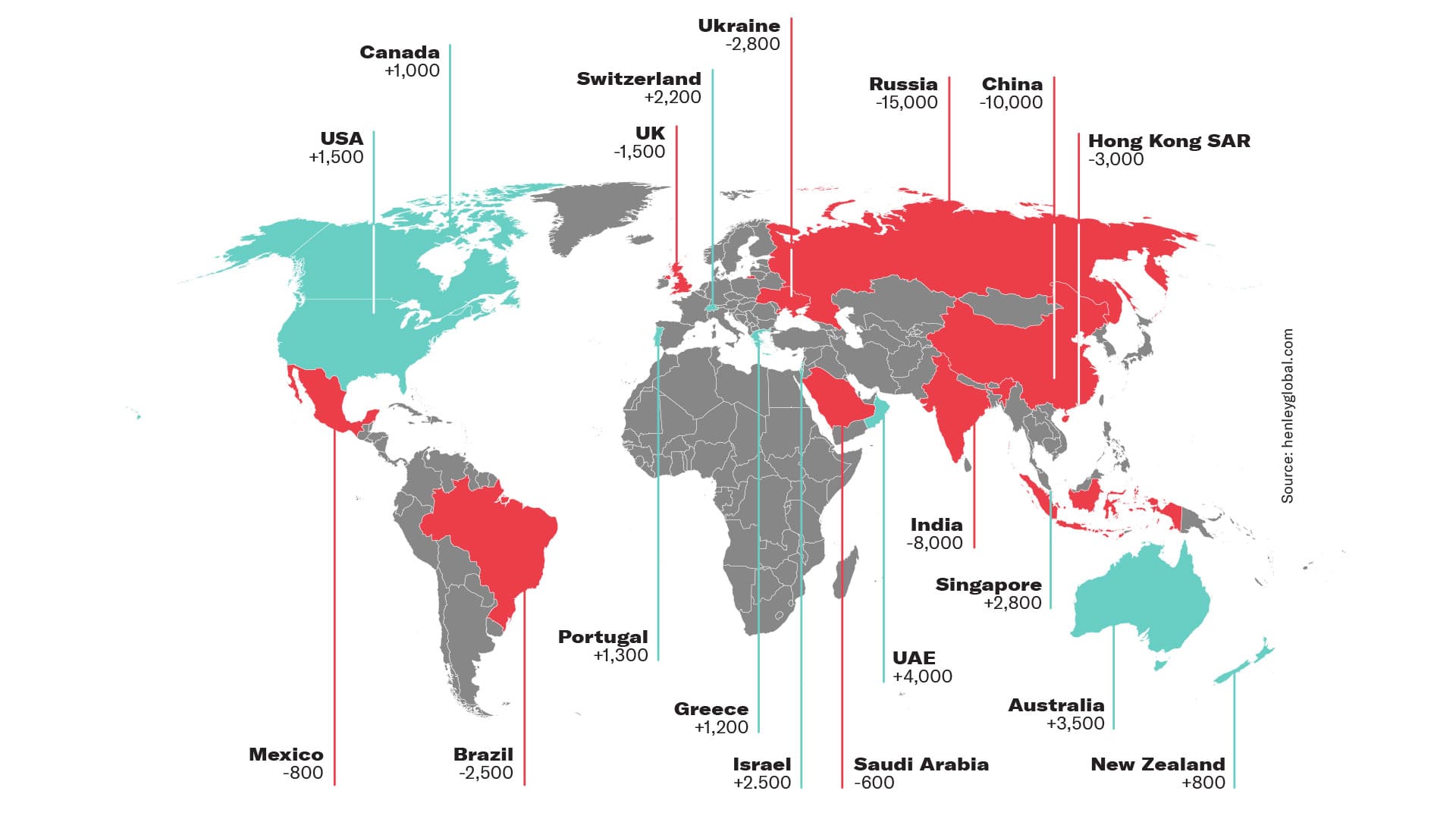

2020 and 2021 had a cooling effect on millionaire migration. Travel numbers went from 110,000 in 2019 down all the way to 12,000 in 2020, and a slight thawing to 25,000 in 2021. With rampant lockdowns and the future looking uncertain, most millionaires hunkered down to wait out the storm. Of course locally we had a few stories of cashed up internationals bunkering down here in New Zealand, but for the most part everybody stayed put. Now that everyone is getting over the whole pandemic thing, migration is starting to rebound. This year the Henley Global Citizens Report is projecting that there will be a global flow of 88,000 millionaires with an even higher spike of 125,000 in 2023. Looking at the chart above, the flows out of certain countries is looking like a no brainer. Most global businesses have pulled out of Russia, diminished their footprint, or cut ties entirely. To continue to do business, a lot of Russian millionaires will have to move abroad. Likewise, Ukraine, which is feeling the full brunt of Russia’s invasion, has significant numbers of civilian refugees fleeing the country, resulting in a 42% loss of its HNWI population.

So why does HNWI movement matter to us? According to Andrew Amoils, Head of Research at New World Wealth, “Affluent individuals are extremely mobile, and their movements can provide an early warning signal into future country trends. Countries that draw wealthy individuals and families to migrate to their shores tend to be robust, with low crime rates, competitive tax rates, and attractive business opportunities.”

The UK has been bleeding HNWIs since Brexit five years ago, perhaps marking its fall as a financial powerhouse. The US has net incomings but don’t let that fool you, it’s down significantly since 2019. Journalist Misha Glenny sees this downturn as possibly being attributed to Biden’s inability to curb the instability left by his predecessor. “In November, the mid-term elections are likely to return a Republican House and possibly the Senate, too. With culture wars between Democrats and Republicans mounting once more with the leaked decision of the Supreme Court to overturn the Roe vs. Wade ruling on abortions, some fear we are entering another period of dramatic instability such as that which characterised the Trump years.”

China has always been billed as the waking dragon and new economic powerhouse, but that hasn’t stopped a major flight of money leaving its shores. Hong Kong saw a major departure a few years ago once the mainland took a more hands on approach to its day to day business, but those numbers are slowly coming down.

“General wealth growth in the country has been slowing over the past few years,” says FutureMap founder Dr. Parag Khanna. “As such, recent outflows of HNWIs may be more damaging than in the past. China’s deteriorating relationships with Australia and the US are also a major long-term concern.”

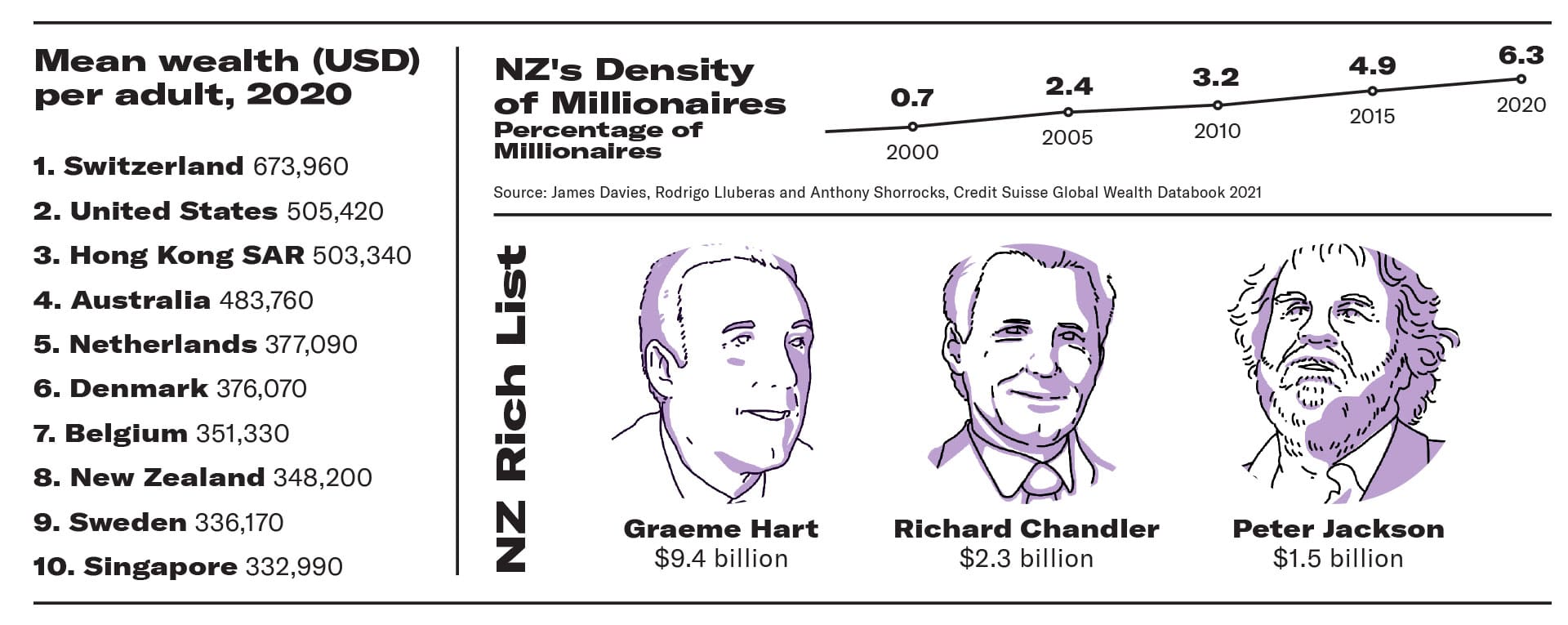

New Zealand is as usual punching well above its weight, generally favoured by wealthy UK migrants. I guess if you’re going to leave the EU, you may as well go the whole hog and go to the opposite side of the planet.

We rank at the top of the Global Peace Index as well as being at the top of the charts for the World Bank’s 2020 Ease of Doing Business ranking. We’re also at the top of every clickbait list of “Where to go during a nuclear apocalypse”, so that’s always nice to see.