Feature Rich: Revolutionising Personal Finance

The macroeconomic landscape over the last couple of years has had global implications, but it has also had a very individual impact on most people. Restrictive credit, inflation, and the general cost of living make for daily headlines. Of course, we don’t need to read the newspaper to know that it can be hard to manage money, let alone set and save for big financial goals. But it is also out of this prickly fiscal environment that has emerged an innovative fintech solution designed to help Kiwis manage their money and be razor-focused on their steps to their financial goals. Booster Savvy is a New Zealand-born innovative fintech solution that not only tracks and manages daily expenses but also incorporates saving tools seamlessly into your financial routine.

Diana Papadopoulos, Chief Customer Officer at Booster, says that the catalyst behind the development of Booster Savvy has come after years of insight. “We have been helping Kiwis save for 25 years. But that has been about saving for the long term. And so when you’ve helped people for that long, you hear a lot about their challenges and their successes along the way. And what we learned through that was one of the hardest things people find is staying on top of their day-to-day budget.” Booster Savvy’s innovative features are designed to tackle these challenges head-on.

And when we say features, we mean feature after feature designed to give more control and transparency over your money.

A key element at the heart of Savvy is a powerful approach to salary and savings management, which allows you to set up different “Stacks” for different savings targets, making the journey toward each goal clear and measurable. You can have Stacks for your dream holiday, a home renovation, or a new home for that matter. This base helps transform these aspirations into tangible plans.

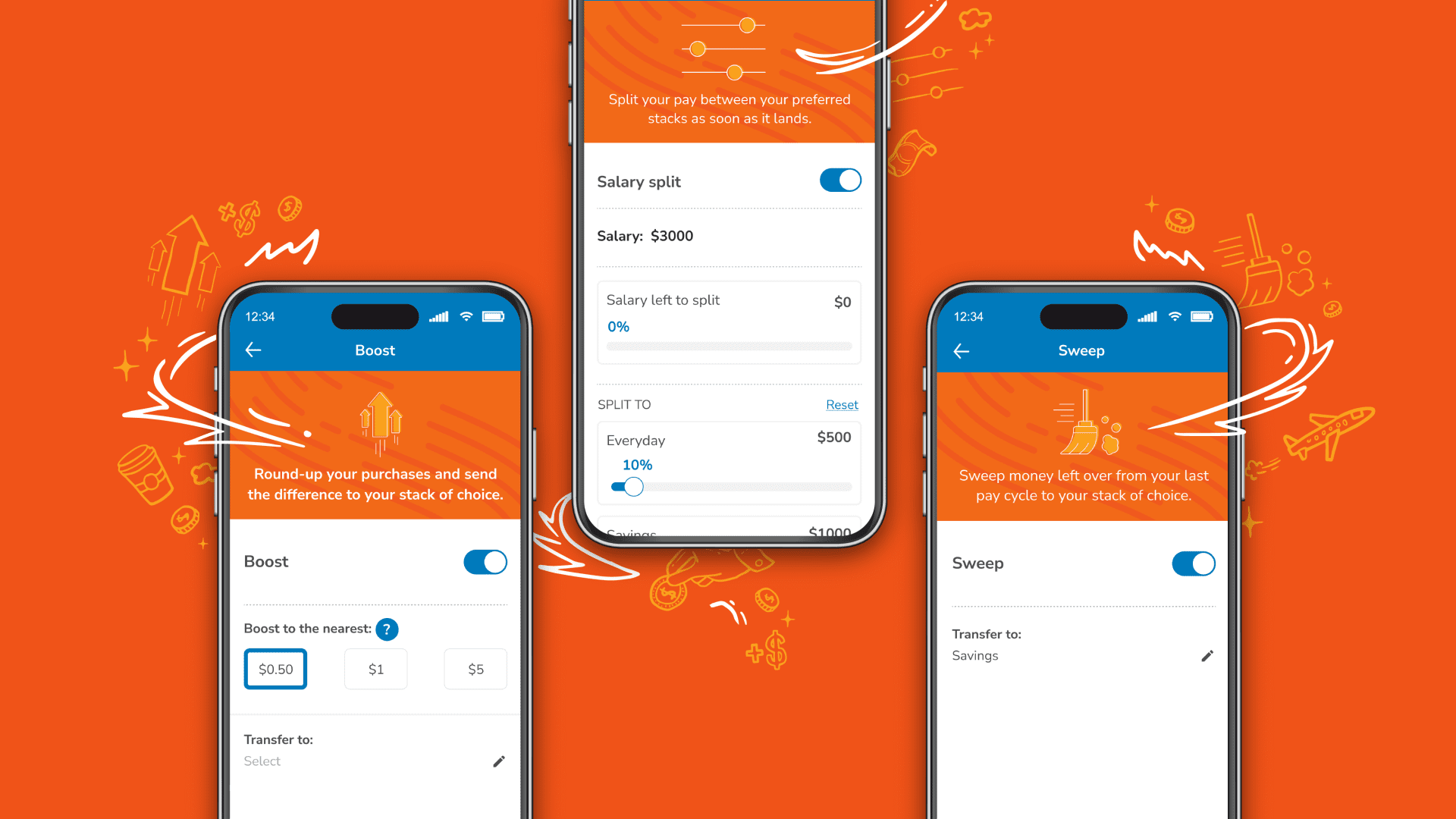

The Salary Split feature adds to the Stack feature by automating the division of your paycheck into these different “Stacks” or categories, tailored to your financial goals. This process simplifies managing expenses and savings, ensuring funds are allocated efficiently every payday without manual intervention. It helps to provide clarity on disposable income, enhancing financial planning and reducing stress associated with manual budgeting.

Another standout feature is the “Boost” function, which rounds up transactions to the nearest dollar and automatically puts the difference into savings. This ramps up the power of micro-savings, making the act of saving so seamless that it goes practically unnoticed. Over time, these small amounts accumulate into significant savings, illustrating the magic of small, consistent actions.

If you have been particularly good with your money, you might notice surplus funds in your account close to payday. Rather than providing a temptation for a bit of splurging, Savvy can proactively nudge you to ‘’Sweep’’ the excess cash in your account into a preset Stack ensuring that every dollar is working towards your financial goals. This not only maximises the efficiency of your funds but also instills a sense of discipline and mindfulness about spending.

There are probably other things you would like to be doing other than forecasting future expenses; luckily Savvy’s “Forecast” feature learns to do the heavy lifting on this for you and brings a level of predictability to your finances. By anticipating upcoming bills and spending patterns, it can help you avoid the pitfalls of unexpected expenses.

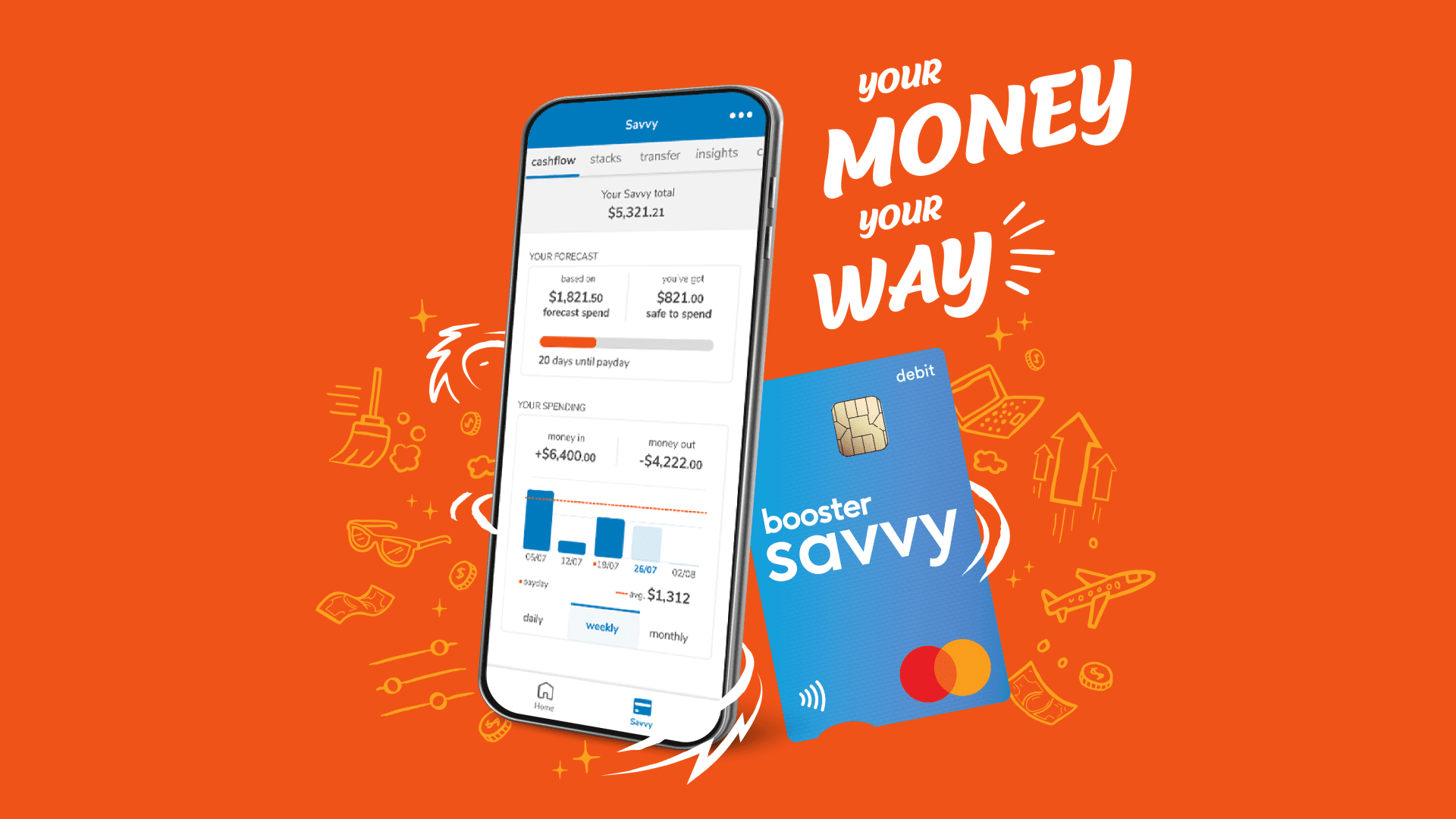

While a lot of Savvy’s features are really about automating goals, the “Cashflow” feature gets you to the crow’s nest and offers a powerful overview of your spending habits. This transparency empowers you to make informed decisions about your money and highlights areas where you may need to reign things in or where you have the opportunity to save more.

Although it is not really a technical feature, a standout element of the Savvy platform is its impressive return rate, sitting at five* percent per annum currently, which gives you a better return than a transactional account generally does, but without compromising on flexibility. Savvy’s also attractive on the cost side of things with no card, monthly account or transaction fees**.

And what ties all these features together is a philosophy that small, daily innovations can lead to significant long-term achievements. It’s not just about managing money; it’s about fostering a healthier financial lifestyle that resonates with the aspirations and realities of Kiwis. By bridging the gap between day-to-day convenience and long-term financial security, it empowers New Zealanders to be in a better position to take control of our financial goals.

Want to get Savvy? Check it out at boostersavvy.co.nz

* This is after fees and before tax. Booster periodically reviews and sets the return rate.

** International transaction and FX fees may apply. Merchants may apply surcharges.

The Booster Savvy Scheme (‘Savvy’) is not a bank account and Booster is not a bank. Savvy is a managed fund and Booster Investment Management Limited is the manager and issuer of Savvy. Savvy’s Product Disclosure Statement and other important information about Savvy (including a comparison highlighting some of the differences between Savvy and a bank account) is available at boostersavvy.co.nz.