First Take On The New Tax Laws

Early in April, the government released new tax policies that specifically targeted the housing sector. The new laws are intended to slow down house prices growth rates across New Zealand in an effort to make it easier for first home buyers to get into the market.

The changes are broad and cover an extensive range of critical areas. Such as freeing up the RMA and making it easier to build new properties. The government has targeted existing landlords and investors by removing the ability to offset the mortgage interest against your income.

These new tax laws and policies, specifically the ability to offset the interest, have hit a particular nerve within the industry. We are scrambling to understand the implications of these changes fully. Offsetting interest is not a loophole; as the government has suggested, it is common practice across all industries. Investing in property is no different – and fundamentally, it is running a business where the client is the tenant. As with many of the Residential Tenancies Act amendments, the unintended but noticeable side effect will be higher rents. We have already seen rents, on average, increase by 23.75% over the last four years due to all the changes.

The government has correctly identified that one of the key drivers behind house prices’ growth is the lack of new builds. And the often-laborious task of obtaining consent to develop or free up land. And that is critical in slowing down inflation, as it is a simple matter of supply and demand. Create more supply; prices will come down.

Introducing new tax laws (as seen in April) will not fix the problem; it will likely create more. You only need to look to our neighbours over in Australia to see that stamp duty, capital gains and other mechanisms have done nothing to curb growth. With no consultation within the sector or industry bodies, and despite the IRD warning against this move, the government have proceeded.

As we all get our heads around these changes, it is essential to read extensively to capture all perspectives. Long term commentators such as Graeme Fowler, Ashley Church or Tony Alexander, to name but a few, often have good pragmatic views and can articulate the implications, both positive and negative, in simple terms of these new tax laws.

As we all get our heads around these changes, it is essential to read extensively to capture all perspectives. Long term commentators such as Graeme Fowler, Ashley Church or Tony Alexander, to name but a few, often have good pragmatic views and can articulate the implications, both positive and negative, in simple terms of these new tax laws.

1. Existing Investors

Investment properties purchased before the 27th of March 2021 have four years before these new tax laws come into effect. This gives current investors breathing room to develop a strategy.

2. Management Fees

Management fees charged by professional agencies continue to be 100% tax deductible. As the industry becomes more litigious and specialised, it is almost essential to engage a professional property manager. The positive news is you can still claim against this service.

3. Know the Numbers

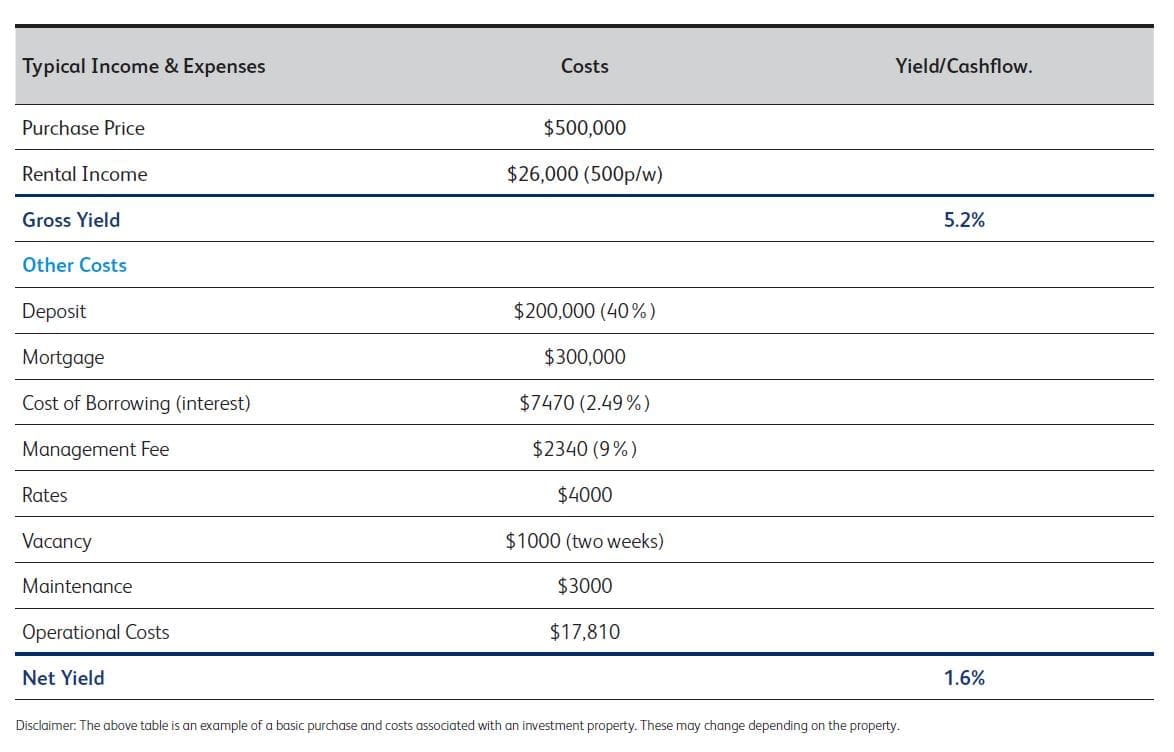

Investors with properties that pre-date the 27th of March need to crunch the numbers to determine the additional costs once they can no longer claim the interest. Talk to specialists in this area, such as financial advisors and accountants. If you are looking to purchase an investment property that is not new, base your numbers on the net costs. (see example below)

4. Four Years to Prepare

Use the next four years, up until March 2025, to slowly lift the rents to generate additional rental income to offset this change. For example, an increase of $40 per week each year over four years would eventually generate an additional $8,320.00 by the time the change comes into effect. Based on a mortgage of $400,000 at the current rate of 2.49%,

the interest component of the mortgage would be $9,960.00. This is a difference of roughly $1500 annually.

5. Rent Reviews

As of August 2020, rent increases can now only happen every 12-months. To prepare for these changes in tax, it is essential that you and your property manager conduct a thorough CMA (Comparable Market Analysis) for each rent review to increase the weekly rent to be aligned with market rent.

6. Do your Homework

The Tenancy Tribunal are becoming increasingly favourable towards tenants if, and when an increase is challenged within the Tenancy Tribunal. For this reason, you need to approach the increase diligently and have sufficient market evidence of reasonably comparable properties. This needs to be recently rented properties and currently available properties.

7. Structuring your Mortgage

Look at the mortgage structure and look to ways to pay down the principle and reduce debt. Many investors are servicing the interest-only, and they may need

to revisit this strategy. Paying down debt also will help to future proof with respects to increased interest rates. (Graeme Fowler released an excellent article on this recently)

8. New Builds

For investors looking to enter the market, look at purchasing new properties. These can be free-standing properties or apartments.

9. Alternative Options for New Builds

Look at opportunities to buy into unit-title apartment blocks as a way of entering the investment market at a reasonable level. Across provincial New

Zealand, it is uncommon to find large scale apartment buildings; however, look for opportunities, and often, buying off the plans can secure a property at a rate lower than market value by the time it is completed.

10. Diversify

Look to diversify your portfolio and look at the commercial sector. Investing in commercial property is vastly different, and in comparison to the current climate in the residential

sector, it feels quite a lot easier. (Property Brokers have a commercial property management department that would welcome any enquiry or questions) For years, many investors have known that residential cash flow is often low or negligible and look for capital gains in this sector. To generate cash flow, they also include commercial properties into the portfolio, which typically generate good cash flow.

Despite these changes, you might be surprised – it can still stack up, and you can wind up with a small amount of cash flow. Across provincial New Zealand, we see in excess of 20% gains

in the capital growth of properties, and over ten years (new Brightline test), you only need to look at the history of the property sector in New Zealand. You can be confident that the value will increase.

For any enquiry or additional information, please feel free to contact the team at Property Brokers.