Blockchain: Back to Basics

I’m the Co-Founder and CEO of Centrality. We’re a Kiwi-based business with about 30 blockchain projects all around the world. We’re deep into this space, we know what’s going on. I’m going to give you a little bit of insight today, no bulls**t, hopefully, because there is a lot of hype out there and a lot of misinformation about what this stuff is, why does it matter and what can we use it for, how can we take advantage of an opportunity here with the technology?

So what is blockchain? I’ll break it into three types of options, depending on how techy you might be. The first, and probably the simplest way to think about it from a no-technology perspective, is kind of like a co-operative. You think about someone like Fonterra, they’ve got lots of different actors, who are providing different things to their ecosystem.

People making milk, tankers driving that milk around, people producing products out of that milk, people selling that milk. They form together to share their resources, pool them together and create something together that’s bigger than the individual components that they bring to the table.

Another way to think about is kind of like a spreadsheet. This is the low tech version of ‘what is blockchain?’ A spreadsheet that nobody owns, but we can trust the information in. Everyone around the world gets to hold a copy of this. When we look at this thing, we can trust that the spreadsheet it telling the truth.

Another way to look at it, could be like open source infrastructure. Everyone’s heard of the cloud, we know that companies build data centres, and inside those data centres they put computers, storage, and all those kinds of things and then we rent that stuff. Well, blockchains are kind of like open source clouds. This is infrastructure that is provided by a cooperative, that is distributed around the world, that people can run applications on top of, but isn’t owned by a single corporation or entity.

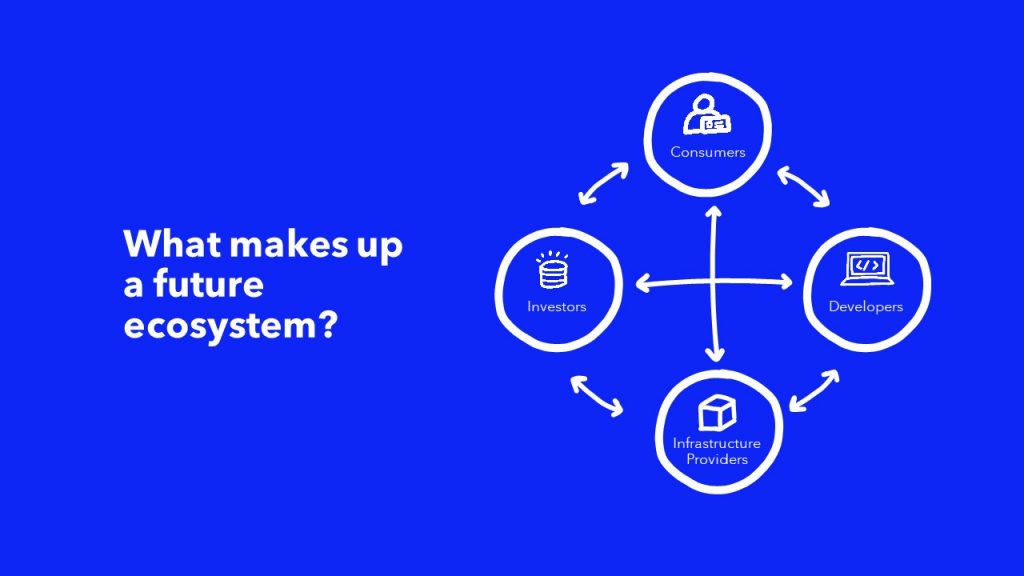

What do these future ecosystems look like and why are they important? In the blockchain world, let’s take an example like bitcoin. We’ve got four primary actors in this ecosystem. We’ve got infrastructure providers. These are the people that provide equipment, you might hear of this equipment being called mining equipment. These are physical servers, computers and storage that connect to each other across the internet, to provide a platform to run the bitcoin software.

You’ve got developers who are building this software. So there’s open source code. Developers all around the world contributing to the project and improving it all the time, checking that it’s secure, testing it, building applications on top of it. You’ve got this huge developer community out there that’s building stuff on top of it.

You’ve got investors. These are people who are making strategic investments in this thing, speculating on this thing, just like traditional financial markets. People are adding value to the network by investing money in it and creating liquidity in the asset that underpins the network.

And then you’ve got consumers. Consumers are using the services that are built on top of these networks. All of this stuff is done, without a corporation. You’ve got a network and an asset out there that is worth hundreds of billions of dollars that doesn’t have a CEO, that doesn’t have a CTO, or a data centre to run their stuff in, or a DevOps team, or a marketing team. This is the power of this technology, to create new types of open systems that we can innovate on top of.

A big part of what makes blockchain special is this thing called decentralisation and you might hear this talked about a lot. And there are varying degrees of what we would call decentralised and there are plenty of projects that aren’t at all.

The key benefit of blockchain technology is decentralisation. That is the ability to break up the ownership of something amongst a community where no one actor is particularly in control of it. And that lends itself to some interesting types of use cases that we’ll talk about later.

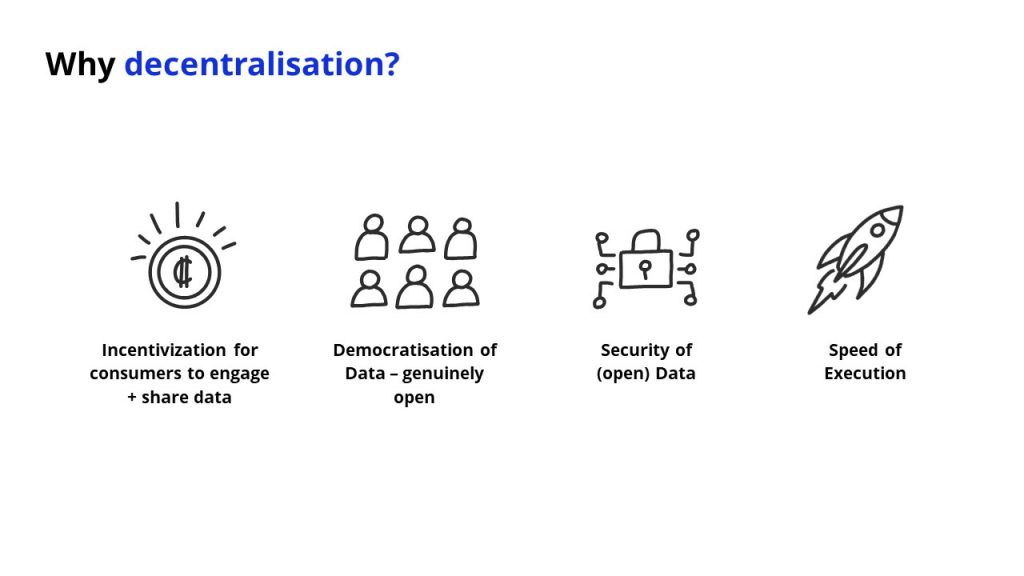

But the big advantages, at the top line, is there’s incentivisation models that can be created for consumers to engage in these new ecosystems in these different ways. We don’t have to be customers of these networks, we can be owners of these networks and that’s quite a paradigm change.

If we look at the opportunities to lift people out of poverty and technology driving more and more centralisation of power, how can we break up some of those things and provide an opportunity for people to participate in new kinds of economies where they’re not just customers, they’re owners?

How can we open data and make it generally a democratic asset? How can we share this in a way that isn’t fundamentally controlled by a single entity who controls the physical computing power, the physical storage and the physical data centre that that data sits in?

We hear a lot about open data, but unless you’re in control of the physical infrastructure that that data sits on, it’s not genuinely open. We can only really build open data in open networks and open computing networks.

Security of that open data is really important. Today, we have a lot of incidences, and it’s increasing around the world, where we store data with third party providers and that data is stolen. Is there a way to build a system where we can store data in a cloud where the risk of it being stolen is lower?

Some of the ways this technology is implemented allows that to happen because instead of trusting someone with the keys to that data, which we do in a traditional scenario, we actually hold those keys ourselves. To access that data, they have to attack every single user and steal their keys. We can operate different kinds of security models.

And another important thing is the speed of execution. We find a lot, in the work that we’re doing, that there are people who want to collaborate in an ecosystem, maybe they’re competitors even, but they’ve got a shared common good. They try and try and try to come together to build common technology and the problem keeps coming up over who owns this thing, who owns the customers, who owns the physical infrastructure that it sits on?

Some examples of these types of things that, even in New Zealand, where consortiums have come together to try and build something and they get caught up in internal politics around ownership and control. These types of systems allow us to open innovate. We’ve got open infrastructure, we’ve got agreed protocols and rules and software managers, but anyone is free to innovate on top of that in the way that they choose. We can speed up the pace of innovation.

Summing all of that up, I think the most important thing about decentralisation is, it’s the opposite of centralisation. If we look out there around the world, we’ve got 65 people who own 50% of the world’s wealth, that’s centralisation at the extreme. I can bet if we continue to centralise power, particularly as technology enables mega corporations to do that, that you’re not going to be on the side of the 1%. The vast majority of people are going to be losers in centralisation.

It’s about restoring balance in the force. An opportunity for us to take a different type of approach to break up some of those concentrations of power and wealth that are existing now.

Why do we need this? We’ve got this sharing economy, we’ve all heard about the different kinds of sharing ecosystems out there, we don’t need blockchain to give us this capability. But I think it’s important to look under the hood of this sharing economy. One thing you’ll find that is becoming increasingly apparent is not much is actually shared. We’ve got lots of platforms around the world that are sharing platforms, but actually what’s happening is a lot of the value is being hoovered up inside of those ecosystems and shared only with a small number of people. There might be lots of participants participating in those ecosystems, but it’s not genuinely sharing the wealth of those systems.

There are a lot business models in the sharing space that are actively looking to push out the sharers that are sharing in that wealth. If you take a look at say the shared transportation applications out there that are actively looking to push out the drivers that are helping them build their business today. That’s one example where the sharing economy isn’t so sharing. I think we need to look at how we can change the dynamics of truly sharing.

The other thing is, we’re in the middle of a war at the moment. You look at all the big industrial revolutions that have come through in the past, and very often you’ll see big actors coming along and taking control of the most valuable assets in that industrial revolution. In the previous one, we’ve seen these big moves, political plays, and wars fought around fossil fuels which was the big engine in that economy that we’ve just come out of.

We’re now in the digital economy and, as that digital economy grows and grows, what is the most valuable underlying asset? What’s the core thing that’s important? What’s the thing worth fighting for now? It’s data.

Data is the fuel of the digital economy and right now, there is a war going on. We might not know it, but there are corporations all over the world that are trying as hard as they can to get control of that asset, because it’s going to be the most valuable thing in the future. It’s the oil of the future.

Everyday, we are giving up our rights to those things. Just like tangata whenua’s rights were taken from them, surreptitiously in some cases, the same thing is happening now.

We’re seeing people come in, slowly grab this gold, create these big, vast fortunes of digital assets that will drive the way the future works. Getting control of our data is a super important thing and we have a moment in time to do that.

There will be a point where it’s impossible for us to get control back because the systems that use that data will be so smart, and we’ll be looking at those screens everyday, that they’ll influence the way we even think about things. We need to take control now, before we get to the point where their influence grows.

What can we do? How can we make a difference? I think we can change the game from a sharing economy to a social economy. This is something that doesn’t necessarily have to have zero sum outcomes. We can provide common infrastructure, common services, common assets that people can take advantage of to do things that they can do today. We can actually build the types of digital services that we love today without a corporation owning those things.

We’ve proven that in the last 10 years, the history of bitcoin has proven that the world’s most powerful, most secure, most reliable computing network has been run without a single company being involved and being in charge. These are the new possibilities that this type of technology opens for us.

I think we can start to build a privacy-oriented economy, and I bet you now, if you’re investing in or building a tech company that isn’t building a privacy-oriented business model, you will not survive. There is massive pressures that are coming against you. You’ve got technology pressures. There are options now, people don’t have to go down that path. That surveillance, capitalist model is disappearing.

The winners have already won. You’re not going to beat those guys, they have such a headstart on the rest of the world. They have so much data, they know much more about your customers than you do, and they can test things that might take you years to get scale to test, in an instant. They know whether you’re going to be successful before you know it.

The other thing is that regulators are starting to understand, they are starting to say, “Well, privacy is important now”. We’re seeing multi-billion dollar fines coming out now in jurisdictions around the world. We can expect to see this in Western and more advanced jurisdictions, higher economy areas where privacy is being regulated very heavily. That’s putting pressure on how you can create these business models.

Lastly, consumers are starting to wake up. People are starting to understand that their data is important, that there are choices and that privacy does matter.

I think the other thing that is really interesting is that we are moving towards this machine economy and the machine economy is going to be fundamentally different to the way that our economy works now. You’re not going to have as many human interactions in the financial system. Maybe even in the future and the way that we consume services won’t be with a lot of human interactions. We’ll have AI assistants that buy stuff for us, we’ll have AI housekeepers that shop for us. There’ll be machines making transactions with other machines.

As this other type of economy grows, the current fundamental rails of the financial system aren’t set up to deal with a machine-driven economy. We need a different kind of way to transmit value across the internet that exists today, because the current systems simply won’t work.

There’s a whole bunch of mess behind the scenes that you see on your smooth apps at the front around compliance and reconciliation and it drives huge amount of costs that just simply can’t exist in this world where we’ve got billions of internet-connected devices making financial transactions for us.

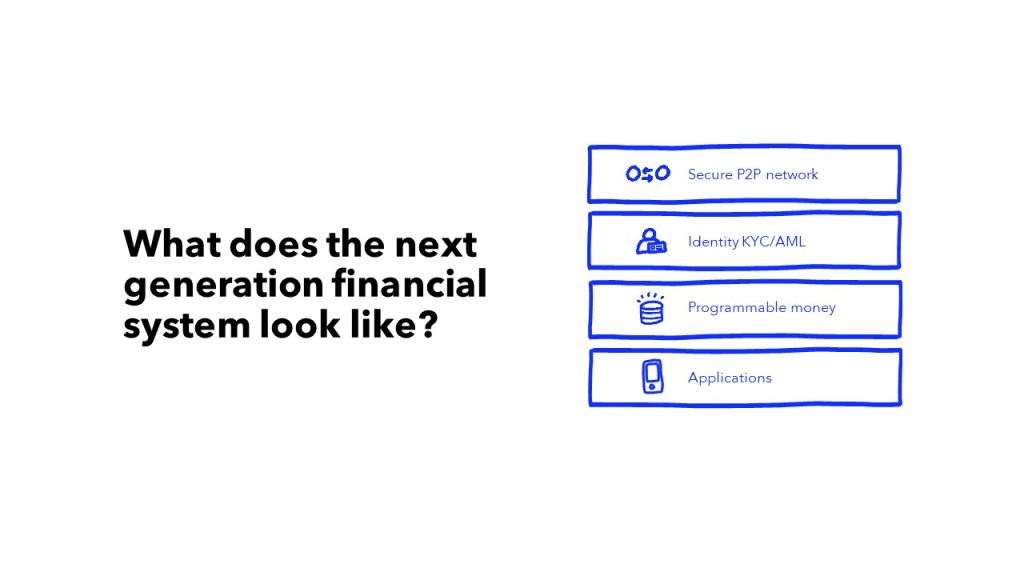

What does that next generation financial system look like? If you think of the rails of the future of technology, you’ve probably got three things. You’ve got a rail for the transfer of value, or money. Money in the future may be different to the way we see money now. In fact, data will be a huge currency in the future. And so these underlying rails for how we transmit value, will most likely be built on these open ledger systems. It’s a very efficient way to transfer value across a digital world.

We’ll have AI that shapes the consumer experience. Whether that’s learning behind the scenes about how we interact with the technology to modify that user experience for us. Whether it’s taking inputs from us, our speech, our gestures, and converting those into actions within those applications, AI will drive the user experience. And then we’ll have IoT, which connects us from our physical world to our digital world. That’s the triangle of the future of technology.

The underpinning of that will be this financial system that will be driven by these ledgers. I think two or three years ago when I would’ve stood up on stage, there were a lot of people saying that that was a crackpot idea. But we’re seeing now, more than 60 percent of the world’s largest corporations are investing heavily in this space. Pretty much every major bank in the world is building technology in this space.

We’ve had arguably the world’s biggest potential economy, Facebook, come out and say out of all the technologies that we could choose to make our entry into fintech, with 2.4 billion customers around the world, we chose this type of technology, because it’s the best suited for building the modern financial system.

What elements do we have in this next financial system? We’ve got this underlying secure peer-to-peer network that works under the scenes, kind of like how Skype use to work. Connections between different computers and phones around the world create this secure network underneath.

On top of that, we can build digital identity solutions. And on top of that, we create programmable money and that is money that has things like compliance built into it. We can create money that has KYC (Know Your Customer) rules built into it. I can’t physically send this money between two wallets, two people, without those two wallets having being previously KYC’d. More secure, more compliant, more safe than cash.

And then we have applications, and the applications built on top of these financial systems, omit all types of value, from monetary value, through to things like data.

I’m going to go through a few examples of things that we’re working on in different areas to give you a sense of the types of opportunity out there for creating new types of customer experience, and new types of economies. The first is an example of what we’ve been working on with a large customer in Japan [Jasmy]. They had an issue where they had customer data that had been hacked and they were very adverse to storing customer information, personally identifiable information on their customers. At the same time, they wanted to be able to provide support to those customers and understand if they had an issue before that hadn’t been resolved and had searched for some help on a particular topic, how could they provide that service without storing that information. So we used these tools and these systems to create a reverse CRM.

In this case, the consumer stores that data themselves, they lock it with their key. They store the history that they’ve been searching in the FAQ’s, they store their personal information, they store the ticket history of interactions with the company. When they call into the help desk, the agent, through chat interface, is able to ask for permission to see that data. The consumer agrees to unlock that data and they share it with the agent, and the agent is able to review the case history, all of that information. The minute the ticket is closed, it’s locked again.

They now do not have a compliance problem around storing customer data. They don’t have a security risk about that data being hacked, but they can still provide a customer experience that’s as good as what they use to provide before.

Another cool thing we are doing, [iomob] one of our ventures now is working in six or seven countries around the world. This is an award-winning business that has won sustainability challenges and innovation challenges with some of the biggest transport and vehicle manufacturers around the world. They’re creating open mobility protocols that allow cities and countries take control of how transport systems evolve in those countries. They bring all the inventory that exists in those countries together and allow people to innovate on top of that data and information.

We can take public transport, private transport, shared transport and put those into a giant transport marketplace where application developers can come and build the best customer experiences on top of. And where those inventory providers have a bit more control about how they get rewarded and how they participate in that economy.

I might have five scooters as a small entrepreneur in a developing market, I can add those to the economy, into the inventory and they can be sucked up and presented by consumer application to consumers.

Changing the way that shared mobility, or shared transport works is a cool way to do this. Because no one owns the system, there’s no fight about who’s in control of the customer or how the applications should be written, or who gets to control the pricing. All of those things go away.

Another really cool thing is supply chains [TrackBack]. You can imagine all sorts of supply chains around the world where there are lots and lots of actors in a supply chain. Maybe they’re producers, manufacturers, shipping companies, logistics companies, retailers, they’ve all got a part to play in the supply chain. Each one of those will have different systems in their businesses and those different systems will have silos of data. They all need to interact with each other to create a really efficient customer process. Big organisations are generally made more efficient by having supply chains that are very tight, where they can share information across that supply chain. It gives an advantage.

How do we allow small businesses to compete in a world where consolidation of supply chains helps you win? We can do the same kinds of things with this technology. We can allow these businesses to connect, share their data in a system, build applications that work across that data, without there being an owner of the system. They can get the benefits of those bigger organisations, without having to give up control. We can foster small business and innovation across supply chains with greater efficiency.

Another really powerful area is financial markets. Chain Financial is another one of our ventures that is working with fierce competitors in the banking and finance space to help them find ways to cooperate on important things, like anti-money laundering and KYC compliance requirements. How can we provide a way that those organisations to compete with each other, can share information in a secure way that consumers have a say in how that information is shared and the outcome is that they’re all more compliant?

This is the type of technology that allows no one entity to be controlled by the system. That’s how Facebook gets Visa, Paypal, Mastercard all to participate in Libra, because none of them are in control. They are all able to innovate freely, even though they are fierce competitors.

Another really exciting one, is Sylo. This is a way for us to create a new generation of social networks. It’s a protocol that allows people to create communications applications, and store information, data and content, in an open way that is controlled by the end user.

Sylo also has an application that sits on top of that, but anyone can build an application on the protocol. This allows us to create new types of social networks where consumers are in control of their data, where a corporation never gets to touch it unless the consumer specifically agrees to it, and where they get the opportunity to monetise that data in different ways.

Even better than that, the consumers get to be owners of the system as they provide infrastructure to it. That infrastructure could be just simply running the app on your phone. Instead of having a corporation to run these types of social networks, we can now have consumers in control of how their data is used and shared in these ecosystems.

Dominic Bowden: What is the take home? What are the first steps that they can do? How important is it to really know what’s under the hood?

Different people in your organisation would have to have a different level of understanding. But I think the most important thing to take away is that shared infrastructure view. How can we create cooperatives which share infrastructure where there isn’t an owner of that infrastructure and we can innovate freely with applications?

The second thing is we can now create new kinds of business models which don’t rely on these central parties to be in control to create valuable economies. That’s going to fundamentally change the way business can be done in the future. And you think about it, as a consumer, if I have the choice to use an application where the corporation gets all the benefit, or the community gets all the benefit – which one am I going to choose? That’s where consumers are going to want to go.

And that third thing is privacy. This privacy economy is coming, it’s going to be a juggernaut. If you’re not building stuff that puts the consumer privacy first, and puts them in control of their data, you’re going to be out of business.

You talk about big business in America and New Zealand is following. Give us some examples of how many big businesses are actually investing in this tech.

More than 60 percent of Fortune 500 companies are making active investments in this space or are actively building technology in this space. At least 80 percent of the top financial institutions of the world are building in this space. We are working with a number of them. I think one of the biggest holders of patents in this space is the Bank of America.

They might be talking about it in negative terms, to try and protect their dominant positions right now, but they are all actively building and investing in this technology behind the scenes. Don’t listen to what people say, look at what they do.

When are we going to be able to see some of the things you’re working on in the real world?

Sylo’s an active beta now, it’s the fastest growing decentralised app in the world. You can download Sylo from the App Store. And we’re about to turn that beta switch off soon, so we’re be pushing it hard.

A lot of that is around a messaging app right. If you simplify it, a lot of these apps are a blockchain version of Whatsapp.

The key difference is it works just like Whatsapp, except we don’t need someone running a data centre to do things like back your contacts up or store the relationship between you and your friends, or exchange keys for encryption, those kinds of things.

For all the toe dippers out there who want to get in and do some research, is Centrality the place to start? What would you encourage everyone here if they wanted to get a blockchain element into their business?

Check out our website, there are some cool blogs on there about how the technology works and the types of industries it’s been used in. We’re working with 30 different ventures in our portfolio around the world, so we’re across every type of industry. I’d encourage everyone to watch the documentaries on Netflix, Banking On Bitcoin or The Trust Machine. Those are two very good places to start to get a basic understanding of how this all works and what the change might be in the future.