Opening the Hatch on Investing

“HATCH GIVES KIWIS EASY ACCESS TO THE WORLD’S BIGGEST SHARE MARKETS. […] KIWI INVESTORS WANT TO OWN A SLICE OF THESE BIG BUSINESSES AND NOW THEY CAN DO SO EASILY AND AFFORDABLY.”

HATCH GENERAL MANAGER, KRISTEN LUNMAN

It’s a big wide world out there, with markets for absolutely anything popping out of the woodwork. Businesses around the world are growing rapidly before our eyes via funding rounds, and the “Unicorn” is an ever more common phenomenon. Share market investing has always been thought of as a game played by cleanly-shaven, middle-aged guys in Armani suits with luxury mansions in Remuera, who smoke cigars and drive fast cars. Not any more though. New Zealanders are changing their investment game and it’s going to play into our hands… and pockets.

Kiwi Wealth, sister-company to Kiwibank, have launched a personable platform for investors to grow their enormous (or not so) wealth, providing access to over 2,900 companies and 500 exchange-traded funds (ETFs) listed on the Nasdaq and New York Stock Exchange (NYSE).

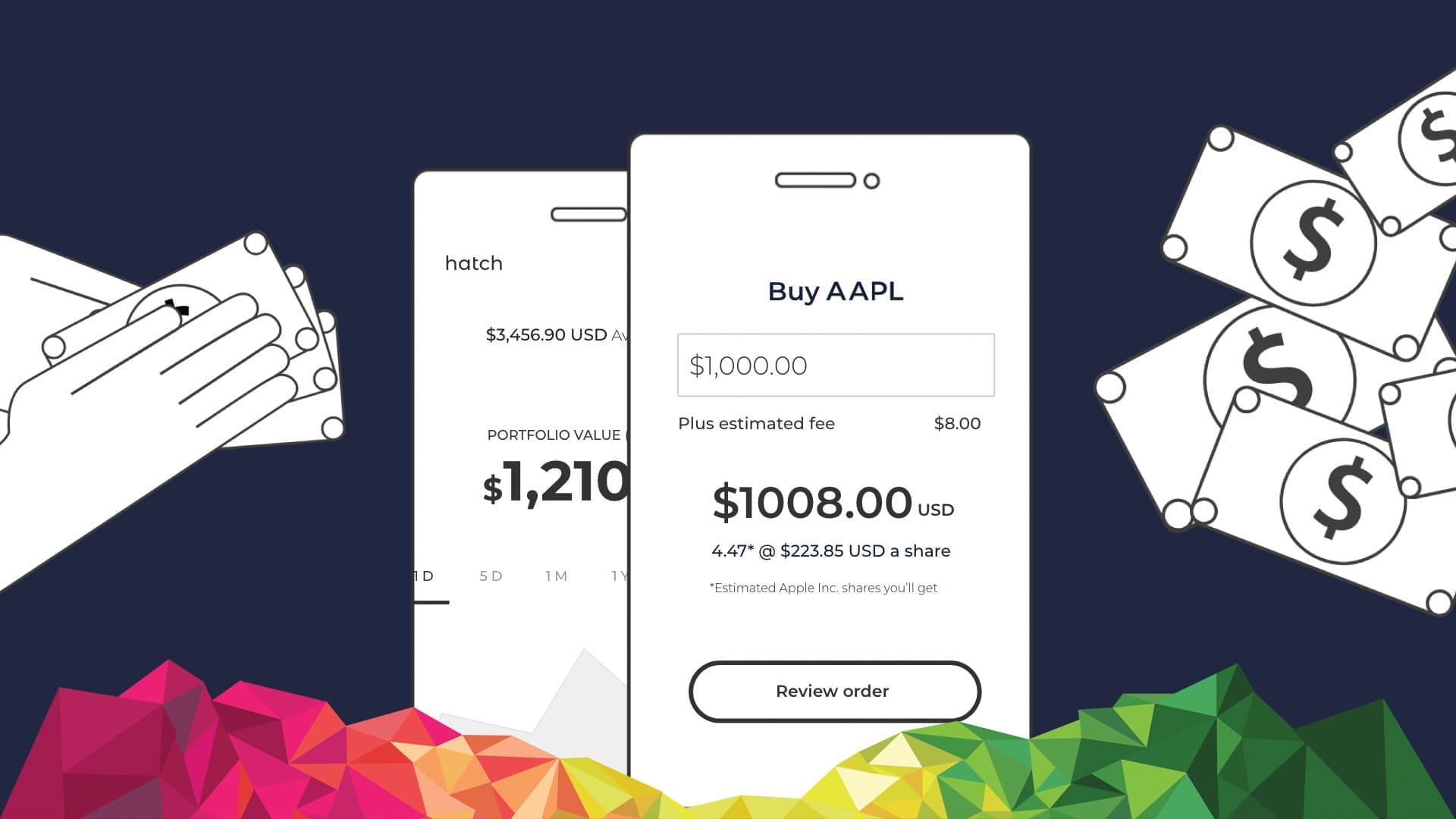

Introducing Hatch, a platform on your computer or smart device that provides an easy way to buy US-listed shares, without having to endure the complicated rigmarole and high fees of a bank or traditional broker. With bluechip companies like Facebook, Alibaba, Apple, Netflix and Tesla, the wealth (pun intended) of the US market is at your fingertips.

Does buying shares in accordance with your budget sound good? Even if your budget doesn’t quite stretch to that of a Wall Street hedge fund? Normally, you would buy a set amount of shares, but with Hatch, you can invest as much or as little as you like, and buy portions of shares that meet your budget requirements. Not everyone has the ability to buy a whole Amazon share (currently trading at around USD$1,700), but we all want to profit off of Jeff Bezos’ mastermind, right? Hatch allows you to deposit how much you want to invest and buy a portion of a share, pocket-sized and able to slide right into your wallet, without a minimum investment.

Hatch has concocted a way to make their platform stand out above the rest. With low brokerage fees and low exchange fees, as well as taking care of your US tax obligations for you, Hatch’s platform is simple, easy and low cost, perfect for the weekend warrior of investing.

In case you were wondering just how easy, here’s a step-by-step guide to show you:

Step 1: Sign-up and verify that you are who you say you are (all online, in about 5 mins).

Step 2: Deposit, deposit, deposit.

Step 3: Decide which shares you want to buy.

Step 4: Invest, invest, invest.

Step 5: Watch your portfolio blossom.

Since its launch last September, Hatch customers have invested nearly $10 million in US-listed companies like Amazon, Aurora Cannabis, Google and many more. Hatch is a must for Kiwi investors, as they become more confident, educated and diversified with their investment and wealth. Admittedly, it was a lot more difficult in the yonder years to put money into overseas markets, with complex banking, confusing jargon and off-putting fees. Luckily, Hatch can help out.

As I conclude, I am reminded of something Ms. Donovan-Skeens said to me in Business Studies, Year 8. “Investing isn’t as confusing as you might originally think”… and now that’s very true. Hatch has saved us all from the confusion and frustration often associated with investing. The perfect option for the armchair investor, the sideline shareholder, or the money-crazed Wall Street broker in all of us.

For more information visit hatchinvest.nz