Change Up: Disrupting The Global Financial World From New Zealand

In the vast and murky landscape of blockchain technology, crypto and fiat currency movements a New Zealand company is working on a new era of financial empowerment for everyday users through their innovative platform, Roundable. And what started as a bold vision to bridge the gap between traditional finance and the blockchain realm is growing into an ecosystem that is setting out to revolutionise how individuals manage and invest their money.

The origins of Roundable.io is based on an unlikely partnership between Michael Moran, a seasoned accountant and Matt Smith, a leading blockchain expert who brought together their unique expertise and perspectives to carve out a disruptive path in the world of crypto and finance.

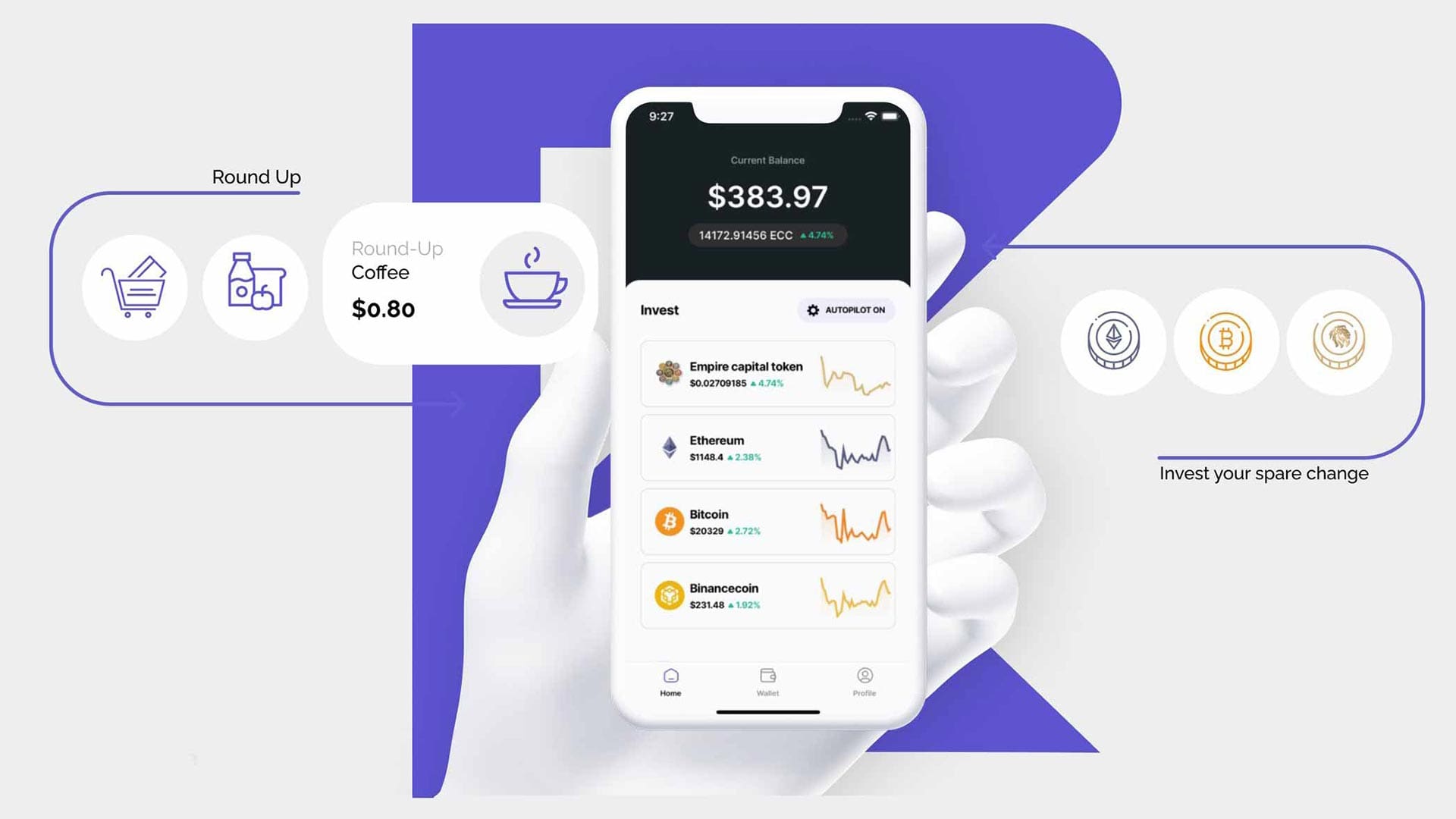

The duo’s shared vision led to the birth of Roundable, a platform that bridges the gap between traditional financial practices and the world of blockchain. Roundable.io’s core concept of “rounding up” everyday transactions to accumulate cryptocurrencies represented a novel approach that aimed to make crypto ownership a part of people’s daily lives.

“The idea of rounding up transactions to accumulate crypto wasn’t just a gimmick. It was a way to incorporate blockchain technology into the fabric of people’s lives,” says Michael. “We wanted to create a habit of saving and investing in cryptocurrencies, and the rounding up concept was the perfect way to achieve that.”

Matt’s technical expertise was instrumental in turning this vision into reality. He recalls, “Building the infrastructure for Roundable.io was a unique challenge. We needed to seamlessly integrate blockchain technology with everyday financial transactions while ensuring security and user-friendliness. It was a delicate balance that required a deep understanding of both worlds.”

Their partnership was founded on more than just complementary skill sets; it was rooted in trust and a shared commitment to doing things the right way from the start.

“I was introduced into the space as a miner and have been involved since the early days,” Matt recalls. His initiation into the world of blockchain came in the form of a transformative encounter with the Bitcoin code. “When I read the Bitcoin code, I read it from start to finish, had to read it again, and then realised that this is a true decentralised store of wealth,” he shares. This revelation served as the catalyst for Matt’s deep dive into the world of cryptocurrencies, as he recognised the potential to redefine traditional financial systems.

For Matt, joining the decentralised network wasn’t just about technological adoption—it was a philosophical alignment. “I joined the network. And then since then there’s been, well probably over 10 years of learning and development,” he explains. This period of exploration saw Matt engage in diverse projects within the cryptocurrency space, experimenting, building, and collaborating. A pivotal moment arrived when he became involved in the Ethereum ecosystem, contributing to the creation and maintenance of blockchains.

However, Matt’s journey was also marked by a recognition of the exploitation of many projects in the past. “I’ve seen this done many times and been done wrong many times before,” he observes. The allure of cryptocurrencies often led to endeavours driven by wrong intentions, resulting in the loss of assets and the erosion of the technology’s true potential. The key, as Matt understood, lay in upholding the principles of decentralisation while delivering practical and user-friendly solutions.

This concept of true ownership and empowerment became an important cornerstone for Michael and Matt in terms of the philosophy that Roundable would be built on.

“All of the assets that are purchased through our app go directly into your own wallet versus nearly every other service out there because it’s centralised, it goes into their wallet and then that’s where fees and things are generated and trading and things along those lines,” Matt explains with a sense of purpose. The significance of this distinction cannot be overstated. While centralised platforms may provide convenience, they often compromise the very essence of cryptocurrencies—the control and ownership of one’s digital assets.

Centralised systems typically act as intermediaries, holding users’ assets on their behalf. This arrangement exposes users to potential risks, including security breaches, third-party control, and the imposition of fees. Roundable challenges this paradigm by ensuring that all assets purchased through the platform are directly deposited into users’ personal wallets.

“That’s my driver behind this was just to make sure that if we’re gonna help people move into this space, that we make sure it’s done properly and in a way that they have true ownership of their wealth,” Matt emphasises.

“Baked into the operating model is the removal of any opportunity to do those bad things. We’re not a custodial service, we’re not leveraging your assets to go up and buy other things. We’re basically facilitating your entrance into the asset class. I think being able to explain to the public why we won’t put ourselves even in a position to do that with a product helps them to think about how they should be thinking about where they should be placing things. Because if that risk exists, they should think twice about putting their wealth there.” Says Michael.

Also, important to the pair was to build in the potential of cryptocurrency to be an equaliser at a time when many people are getting shut out of traditional asset classes and investment options. The founders also recognized that while the crypto landscape is also not always as accessible as it could be.

“Access to crypto, it seems frictionless if you kind of know your way around IT. But what does that look like when you’ve got no one around you that’s particularly savvy with IT? If your access to technology itself is limited because you can’t afford a MacBook or whatever, or you just don’t think it’s for you because when you see that on the internet, it’s people who drive Lambos. I think that understanding the difference between crypto as something that you use to pay for and crypto as a storage of value that’s borderless and away from government control requires education. And I think that we’ve flagged a dead horse when it comes to trying to teach kids about KiwiSaver and houses, the asset class itself is becoming further and further out of reach for a lot of people.

Whereas you can start small with crypto, but it can grow really, really big because market forces are all in your favour really as more and more adoption happens and things like that. As central banks accept the asset class, there’s a real decoupling between the cheap coins stuff, where you know, that’s where the Lambo bros might play the most. And high-grade cryptos like Bitcoin, Ethereum, and then the ones that we list on the app.” Explains Michael.

“It’s giving someone a safe place to start their journey. And one thing I’ve learned myself is the more you start to look at it, and you think about it properly, the more you understand what it’s for and it’s about your future. And getting people to think about their future is never a bad thing.”

Along the way, Michael and Matt discovered that their differences have become an asset. Michael’s unconventional approach and willingness to step outside his comfort zone often challenged traditional notions of finance. He recalls, “I used to make Matt cringe with my quirky videos and unorthodox methods. But in the end, our community embraced it, and it became a symbol of our authenticity.”

Matt, on the other hand, brought a deep technical understanding of blockchain and a commitment to building practical solutions that could bridge the gap between technology and everyday life. “We wanted to create something that wasn’t just theoretical, but genuinely useful to people.” Says Matt.

Michael’s experience tidying up corporate structures also helped to shape the business approach for Roundable in a way that focused on a strong go to market strategy.

“This is built around a big bang launch in multiple very large territories with the North American market being our primary territory. So with that intent, we knew what we needed to do, the type of people we needed to do from a corporate perspective to actually bring that to life. I’ve also never had to ever worry about any of our tech because Matt always delivers a full architecture. Even the blockchain that it works on is from the start built to be green so we don’t have to worry about offsetting.” Says Michael.

And a lot of this business efficiency has come from the technical capability of the team. “being part of the original Bitcoin core and the original code being part of Ethereum and Ethereum’s code and then seeing the progression in the last five years, we have developed our chain as eco-friendly as possible. So we don’t have the mining infrastructure required to run our chain, so we don’t need to burn gigawatts of electricity every day. And that’s essentially allowed us to leap forward 10 years in technology as well as be set up for any type of carbon impacts that may be coming across the globe in the next sort of four to eight years as well.” Explains Matt.

As well as building a sustainable long-term architecture, Matt’s experience and connections has allowed them to offer up some cutting-edge utility.

“We can now move fiat in nearly three to four regions of the world directly from your account and credit your wallet with crypto in both directions. So it’s a very powerful system.” Matt’s trust within the crypto community has also allowed Roundable to integrate with the likes of Bitcoin and Ethereum, and have direct communication and contact with these projects as well. “I’ve actually worked with most of these projects in the past, integrating with their chain and working on their chains which has allowed us to bring in these partners into our ecosystem. So we’re actually just listing trusted and ecosystems that we’re working with directly.”

And Roundable has hit the ground running. The platform’s unique combination of simplicity, accessibility, and blockchain technology has garnered a growing community and partnerships with large global players. This global traction also speaks to a wider holistic ambition to create a platform that democratises access to cryptocurrencies, redefines financial norms, and fosters societal good.

This focus on building a comprehensive ecosystem was driven by a shared ethos of disrupting conventional financial paradigms. “We understood that spare change was just the tip of the iceberg,” Michael reflects. “Our goal was to create a full-fledged ecosystem that would revolutionise the way people interact with their finances.”

Central to this vision was the desire to empower individuals with financial agency. Matt suggests, “We aimed to shift the power dynamic in finance. Instead of relying on intermediaries and traditional institutions, we wanted individuals to have direct control over their wealth, investments, and digital assets.”

The founders envision Roundable as being able to play a role in helping to redefine existing financial systems. “Our stable coin and peer-to-peer transactions aim to reshape the way people transact and invest,” says Matt. “We’re working towards a future where the barriers between traditional and digital finance dissolve, and everyone can benefit from the opportunities offered by blockchain technology.”

Moreover, the duo’s expansion strategy reflects their strategic foresight and global outlook. While the United States emerged as a launchpad due to existing partnerships, their Canadian connection underscores a broader North American perspective. “Our partnerships in Canada enable us to access vast databases and reach a wider audience,” Michael explains. “This strategic positioning allows us to make a significant impact on a global scale.”

And as much as there is a large global ambition the pair are conscious of keeping the focus on the needs of individual users. “Our driving force has always been to empower individuals with the tools they need to take control of their financial futures,” Michael emphasises. Roundable’s user-centric approach is a testament to this commitment. By simplifying the complexities of cryptocurrency and blockchain technology, the platform demystifies the once-intimidating world of digital assets. Matt adds, “We believe that everyone should have access to the benefits of cryptocurrencies, and our ecosystem serves as a bridge.”

Central to Roundable’s mission is its emphasis on financial literacy and education. “We recognize that knowledge is key to embracing change,” says Michael. Roundable goes beyond transactional capabilities; it provides resources, guides, and insights to enhance users’ understanding of cryptocurrencies and blockchain. In doing so, the platform empowers individuals to make informed decisions about their financial journeys.

And while Roundable has an ambitious focus it has a foundation based on personal integrity and the trust of its founders. “My business relationship with Matt is hard-won trust but our intentions and our actions have made that trust well-founded. Explains Michael. Matt always does what he says. He’s always got my back. I learn from him all the time and we’ve built something with good intent and a big heart.”

The Lifestyle You’ll Love

Located in the desirable, double Grammar Zone, inner-city suburb of Parnell.

Newmarket Residences

New apartments available starting from $1,199,000 Dual keys and $1,499,000 2 bed