Here Are The Most Infamous Short Traders Putting Billions On The Line

They stalk Wall Street looking for dodgy businesses to short, and business is booming. They have shaken finance to its very core with their larger than life attacks and prescience on where the market is going. Are they heroes or villains? Has morality ever even had a place in finance? Why should we start now? These are the stories of the biggest and most controversial short sellers in the business.

Short stocks have been entering the public consciousness more and more these last couple of years. For the uninitiated, shorting is essentially borrowing stocks when they’re priced high and selling them on with the expectation that their future value is going to be lower than what you borrowed them at. You then close your position at the new lower price and pocket the difference of what they were borrowed at. You’re betting that the company will underperform.

This strategy isn’t as available for retail traders here in New Zealand and I don’t consider that a bad thing. Being able to quickly and easily short a position while sitting on the toilet is inviting disaster for the casual investor. The catch is that if you’re wrong and the stock goes up in value, closing the position gets expensive. The stock might keep climbing forever and you’ll never get your clean exit. You’ve got infinite losses, my friend. If your provider doesn’t believe you have the capital to close, they’ll do it for you, cleaning out your account in no time at all. This is a particularly fun way to zero out a FOREX account by leveraging 10x/100x while you’re at it.

Now that we’re done with the beginners guide, let’s take a good long look at some of the most famous short sellers today.

Bill Gates

Gates has always struck me as a very positive person, so to hear he has a short position in anything at all came as somewhat of a surprise. The reveal came from leaked texts stemming from the enigmatic Elon Musk, who’s been pissy at Bill for taking out a short position on his company Tesla.

“Do you still have a half billion dollar short position against Tesla?” Musk queried him in April.

“Sorry to say I haven’t closed it out,” responded Gates. “I would like to discuss philanthropy possibilities.”

“Sorry, but I cannot take your philanthropy on climate change seriously when you have a massive short position against Tesla, the company doing the most to solve climate change,” Musk texted Gates, seemingly unaware that you don’t need to be all in on every single project to still be all in on climate change.

Elon confirmed the messages were real, noting he hadn’t been the one to leak them and that “I heard from multiple people at TED that Gates still had half billion short against Tesla, which is why I asked him, so it’s not exactly top secret.”

Musk claimed in May that to close the $500 million position now would cost Bill “$1.5B to $2B to close it out” due to Tesla’s stocks going up.

Bill has stated that he doesn’t publicly talk about his investments, although he did have this to say about the fracas. “I give a lot more to climate change than Elon or anyone else,” Gates said. “I give a lot of philanthropic dollars, I back companies – you know electric cars are about 16% of emissions, so we also need to solve that other 84%. He’s done a great job, but somebody shorting the stock doesn’t slow him down or hurt him in any way.”

Somehow this entire piece became about Musk, as it always does when he has even the barest whiff of being related to something.

The Most shorted stocks

These are the most shorted stocks listed by percentage of their shares shorted. Data pulled in early June 2022.

AMZN Amazon.com

18.57%

LUMN Lumen Technologies

13.05%

AAL American Airlines Group

13%

CHK Chesapeake Energy

12.9%

TTWO Take-Two Interactive Software

12.42%

Fahmi “The Assassin” Quadir

To gain a nickname on Wall Street, you need to be ruthless and the best of the very best. Fahmi Quadir is both of these things, and she did it all before she hit 30. She worked for two years as an analyst, where she made her most infamous short. She saw Valeant Pharmaceuticals International was pulling some dodgy moves and possible fraudulent practices. She placed her short position in June 2015 near the peak of Valeant’s worth. Between July 2015 and March 2016, the companies stock tanked going from $257 to just $28. The firm she worked for, Krensavage, saw this position she made as their biggest earner. An “untenable” situation with Krensavage saw her leave the company in 2017.

After this, she decided to start her own fund called Safkhet Capital. She started out with just two employees and $6 million to work with, that is not a lot of capital to absorb losses with. She has slowly been building that base fueled by word of mouth based on her reputation and a handy 2018 Netflix documentary called “Dirty Money”. She now manages about $50 million and continues to grow. But it’s still early days, and she has to prove to everyone she isn’t a one trick pony with her Valeant position.

In terms of being a woman in the mans world of Wall Street she says, “Yes, I have faced terrible harassment, but I was always in a position to tell those who belittled me to f**k off.”

The Pariahs

Short sellers are reviled across the board, many see them as vultures feasting off the bones of companies.

This sentiment rose to new prominence during the height of the GameStop short squeeze when r/wallstreetbets retail investors used the sheer power of the crowd to put pressure on short positions. In a quirk of stale data reporting, it was found that GameStop’s peak short interest was 141.8% of its float, something most people didn’t believe should be even possible. “Overgreedy” was the consensus.

Around this time, short sellers began shutting down their social accounts as mobs started to bombard them with death threats. Gabe Plotkin of Melvin Capital Management took the threats so seriously he had to hire security for him and his family.

After taking massive hits to his short position on GameStop, he adapted his strategy but in May 2022 he had to shut up shop as ironically his slumping long positions in Amazon, Microsoft and Live Nation put the final nails in his firm’s coffin.

Activist shorters have to worry about the companies they call out publicly coming after them as well. “Try being a fund manager who goes after organised crime, international money laundering, the Russian mafia, all while managing pocket change,” Fahmi Quadir rhyly told the New York Times. She shares her GPS coordinates with a colleague and her lawyer, you know, just in case.

In 2008, short selling was banned on 1,000 financial stocks with the reason being that it would provide a boost to the shares of banks, brokers and insurers. The rule was dropped eventually and in a post-mortem Harvard study, they found that banning shorting was more detrimental than anything. “In fact, these stocks consistently underperform during the whole period the ban is in effect. This suggests that the shorting ban did not provide an artificial boost in prices,” the study states.

“Short sellers on a stock have nothing, zero, zilch, nada, to do with the success or failure of the underlying business,” Michael Burry tweeted on April 27 of this year. But this doesn’t stop them from being the scapegoats when the bears rule the market.

But Short Sellers see themselves as investigators, and prior to the GFC they were generally seen in a positive light, keeping the market honest.

Whatever your personal opinion on short sellers might be, maybe we should all start thinking like short sellers when considering our investment positions.

“The ideas related to short-selling—the way we approach research, the way we ask questions, this notion of getting to the truth of these companies—I think every investor should do that. If more investors thought about investing like short sellers do, I think you’d have a freer, fairer market,” says Fahmi Quadir. Being a bear about your bullish moves is some good words to live by. Blind optimism just makes you a gambler at the investment table.

Michael Burry

Michael Burry went to stardom after he profiteered hugely off the GFC, shorting the banks and their subprime mortgages, spawning a book and a movie called The Big Short. That’s the short version (ha). Burry saw as early as 2003 and 2004 that the real estate bubble was ready to burst with catastrophic results as early as 2007.

In the years leading up to this analysis, he had continued to beat the market with remarkable results, building up a portfolio of investors who enjoyed nice returns. As things started to heat up and he started to focus more on the subprime market, investors with him got edgy and withdrew their capital. The ones that stuck around to fund the credit default swaps on subprime deals he had persuaded off Goldman Sachs and co, saw over $700 million in profits. He himself saw a personal profit of $100 million.

This win has elevated him to being a celebrity soothsayer, fortelling dark futures and looming collapses of the various companies he shorts. Notably, he held a short position in Tesla at the end of 2020 up until the end of 2021 when he said he was no longer shorting it after it rose 100%.

Not everything he does is shorting though. In 2019, he bought in on GameStop as he saw it was undervalued, even writing letters to the board. In 2021, GameStop would be blessed with meme magic and see an astronomic spike, but we’ll chat a bit more about that one later. But just because he’s gone to the moon with GameStop doesn’t mean he’s onboard with everything else internet bros are investing in. Last year, he was predicting the crash of crypto, and at the time of writing, people’s trashcoins are all heading to zero, and things aren’t looking too good in the short term.

With the current downturn, Burry is also forecasting a further crash in the market, possibly sending the US into a recession. At the end of May, he shared two images, one of declining U.S.

personal savings, and another of skyrocketing outstanding consumer credit. His prognosis: “US Personal Savings fell to 2013 levels, the savings rate to 2008 levels- while revolving credit card debt grew at a record-setting pace back to the pre-COVID peak despite all those $trillions of cash dropped in their laps. Looming: a consumer recession and more earnings trouble.”

Bill Ackman

Bill was in the game as an activist short seller. This means looking into businesses, building a thesis, creating a massive short position, and then publishing their reports for the rest of the market to decide on. A compelling enough report will kick start the decline in the shares they are holding and result in big wins. Letting people know that you don’t believe in a company so much that you’ve put millions of dollars where your mouth is, sure is a pretty compelling way to make an argument. This can be a good way of wiping out dodgy companies, or overinflated businesses.

Ackman may be one of the most famous activist short sellers, but not for any of the reasons he’d prefer. The other player in this story is Carl Icahn, who first interacted with Ackman in 2003. Ackman was in a bind and sold his hedge funds stakes in a real estate company to Icahn on the proviso that Ackman’s remaining investors would get a share of the profits if Icahn ever sold them off. He instantly flipped the real estate company for a 75% gain and declined from sharing profits. The matter went to court and Icahn lost, having to pay Ackman’s investors $9 million plus interest.

Things settled down and for the next nine years, things were fine. In 2012, Ackman announced a short position on Herbalife, a nutrition supplement company which he accused of being a pyramid scheme. He put a $1 billion short position on that basis.

Icahn saw his chance, and placed himself in the opposing corner to back Herbalife. The next year the pair appeared on CNBC and ripped into each other live on TV, airing their dirty laundry and generally having a go. It’s an entertaining ride and well worth checking out on Youtube if you have the chance. Following the public spat, Icahn started to throw an inordinate amount of money into backing Herbalife, and in 2014, he put five of his guys onto the company’s board to help it through a newly opened case the FTC opened against the company’s business practices. An investigation like this is exactly what Ackman needed, and the FTC fined Herbalife $200 million and forced it to restructure its multi-level marketing business. Icahn is filthy rich though, and $200 million is pocket money. He doubles down, increasing his ownership from 25% to 34.99%. For years, the spat between the pair continues with Icahn dipping into his own pockets to fund a one man short squeeze.

The problem was, Ackman was using investor money, while Icahn could afford to pay for his own revenge. By 2019, Ackman was ready to admit defeat, painfully closing his position entirely. After this, Icahn would begin to wind down his position in the company and by mid 2021, Icahn had closed out entirely netting himself an estimated $1.3 billion. The only thing that tastes sweeter than a billion dollars is revenge.

Big Short Squeezes

For many of us, a sudden spike in a stocks value will look like dollar signs. For the would-be short seller, it spells certain doom. A squeeze will test a sellers strategy, sell and eat the loss, or hold and wait for a favourable wind.

Volkswagen

Volkswagen became the largest company in the world for a day in 2008, after bears were caught with their pants down when Porsche suddenly announced it owned 74.1% of Volkswagen, a company people thought was an independent entity. Shares jumped up more than 93%. Short positions liquidated like mad.

Amazon

Amazon earned a short lived squeeze in January 2022, with a record setting single-day gain of $190 billion based on a tasty fourth-quarter earnings report. Unfortunately for them, they set another new record in April when AMZN stocks dipped 14%, their single biggest single-day loss since 2006.

Gamestop

Fueled by meme magic, Gamestop became the first short squeeze fueled by retail traders tasting blood in the water. The fervour online has irrevocably changed the tenor of retail trading and the fallout is still being dealt with today. The squeeze was so strong it helped ensure the shut down of Melvin Capital.

Jim Chanos

Chanos has gathered a number of nicknames for himself over the years, collecting them like the scalps of his enemies. “Darth Vader of Wall Street”, the “Catastrophe Capitalist” and the “LeBron James of short selling” to name just a few. He’s notoriously bearish stating, “I have seen more stocks go to zero than infinity”. It all comes down to fundamentals, going over companies’ financials with a fine tooth comb looking for indescrepencies, rather than just relying on a dismal outlook on the world.

Chanos’s early career actually mirrors the upstart Quadir’s. He too worked a couple gigs as an analyst before striking out and making his own firm called Kynikos, specialising in short selling. The capital he used to start Kynikos came from his early big win betting against Baldwin United, which was cooking the books by basing its value off assumed income and potential revenue. It was a Wall Street darling, but after he revealed its dirty tactics, it quickly folded.

His next big win came with Enron, when the rest of the industry was willfully ignoring their financials in favour of puffed up valuations. He warned that the energy and commodities company was merely a disguised high-risk hedge fund. He wasn’t listened to and a year later in 2001, they filed for bankruptcy after it all came to light that the company was engaging in accounting fraud. This win made him an estimated $500 million in profits.

After a couple wins regarding the usual suspects failing in the GFC, he entered a rough patch as the market entered its long running bull run. This has made him a target for the bulls to take same cheap hits. “Jim Chanos makes money once a decade. While the market rips up, the guy just bleeds money,” Silicon Valley venture capitalist, Chamath Palihapitiya, told CNBC in 2019. “But the reality is being long equities makes sense; being long innovation makes sense. Betting against entrepreneurs who are changing the world has never been a profitable endeavour. Why start now?”

The answer is because sometimes it can make you a lot of money. A year after that soundbite, Chanos cashed in a reported $100 million after fintech company, Wirecard, collapsed. He’d already built a position against the company in 2019, but after Financial Times uncovered a missing $2.2 billion from the companies books, he pumped his position further, cashing in handily from its collapse and the eventual arrest of the former CEO Markus Braun.

“If you’re a fundamental short-seller, the Wirecard story was a classic,” Chanos told the FT. “The buzzwords, the numbers that didn’t make sense, the business model that seemingly didn’t make sense.”

These days, Chanos is cynical of (surprise, surprise) Tesla, although in recent years he’s had to reduce his short to a put position as Tesla climbs and climbs. “Most auto companies trade at one half of revenues because they’re cyclical. Tesla trades at nine or 10 times revenues, a huge 90 times the estimated earnings,” he said as an explanation of his bearish attitude in a 2022 interview with LiveWire Markets.

Recently, he said that Coinbase was “tremendously overvalued”, although as I write this, there is a massive winter hitting both the bus stop I freeze at before work and the financial markets as a whole, including the cryptosphere.

George Soros

You can’t talk about short sellers without talking about George Soros. He’s become known as the man who broke the Bank of England and earning himself a cool $1 billion in the process.

It all started when the British government decided to join the European Rate Mechanism (ERM) in 1990, as both a move to unify with the other European economies and keep a lid on inflation. The ERM was an interim solution to artificially stabilise exchange rates between member countries until a new fangled thing called the Euro was introduced. Member countries were required to keep their currency from fluctuating by more than 6%, just enough flexibility to create liquidity. If the value dipped to the lower band, governments would be forced to intervene. But the pound was a bucking bronco, and there was no way the government could hold onto it as its value went into free fall. They had also set themselves up to fail, as George Soros spotted. They had pegged the pound’s value far too high to maintain reliably.

To maintain the value of the pound, the Government started to pump interest rates up from 10% to 12%, even talking about going even higher to 15%. They also started to buy back the sterling with their reserves of foreign currency. But the collapse had started and it was all working towards a day that would forever be known as Black Wednesday.

George Soros, among others, could tell from a mile off that the pound had been overvalued to start off with and that they couldn’t possibly maintain its current position. At first, he was bullish on the pound, but then started to smell things turning just a month before Black Wednesday. He built up a massive short position on the pound. All the while he was surfing the decline by getting his team to sell off UK gilts and then buy them back up at a lower price later on down the line. Rince and repeat.

On Black Wednesday, the government was buying billions of pound an hour as sell offs came thick and fast. The pressure was so immense, they ended up pulled the plug on their membership entirely. The ripple effects of this blunder was wide reaching. The government in charge wrote itself off as being competent years before the next election. Tony Blaire’s government that followed gave the Bank of England the freedom to call the shots, allowing it to come out from under the government’s thumb.

Soros’s insight earned him a handy $1 billion in the pocket and cemented his position as one of the preeminent currency speculators in the world.

Elon Vs The World

Throughout this piece we have seen that there is a trend among short traders to hate on Tesla. In return, CEO Elon Musk is not above returning fire. Here are the list of names who have at some point put themselves into the crosshairs and what Elon has to say about them.

Michael Burry

“Burry is a broken clock.”

Jim Chanos

“So many reporters gave Chanos airtime when he called Tesla a worthless fraud. Now that he has been proven wrong, silence…”

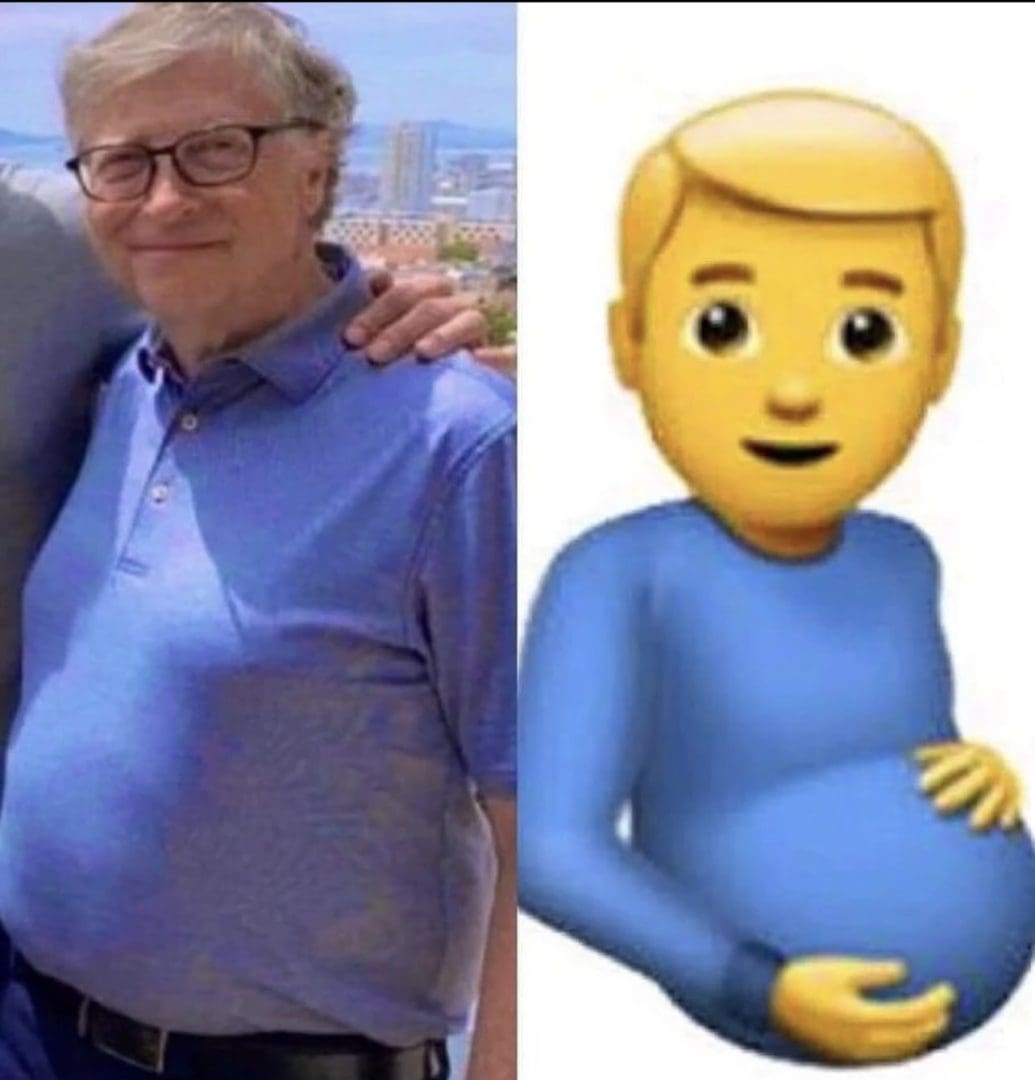

Bill Gates

“in case u need to lose a boner fast”

Every Other Short Seller

“Celebrate summer with Tesla Short Shorts. Run like the wind or entertain like Liberace with our red satin and gold trim design. Relax poolside or lounge indoors year-round with our limited-edition Tesla Short Shorts, featuring our signature Tesla logo in front with ‘S3XY’ across the back. Enjoy exceptional comfort from the closing bell.”

Manu Manek

Manu Manek has a couple nicknames, all cobra based. “The Black Cobra”, “The Cobra of Bombay”, etc. He rose up the ranks during the 70s and 80s to become one of the most influential figures on the Bombay stock exchange. His incredible reach is rumoured to extend all the way to the officials of the exchange who would pay him special favour. “Manek was a legendary personality and a powerful operator who dictated the market. Without his nod, it was impossible to become the director of a company,” Ratilal Choksey, the founder of K R Choksey Shares and Securities says. “Apparently, on the day of the election, he would send the name or list of directors to the companies and only those people ever got elected.”

At the time, lending was pretty exorbitant in India, especially for investments. Manek ran a credit facility charging 20-30% interest to traders. In the process of doing this, he also had an inside line on which shares his lenders were going to be targeting.

Honestly, the more you hear about Manek the more he sounds less like a businessman and more like a gangster. The nail in the coffin was his Bear Cartel, which was made up of a number of lackeys with enough capital among them to move the market as they pleased. That was until the cartel came up against Reliance Industries Limited, run by one of India’s most successful entrepreneurs, Mukesh Dhirubhai Ambani.

The Bear Cartel started to put pressure on, and in return Ambani activated a body known as Friends of Reliance Association. This group started to buy back shares shorted by Manek, stabilising the stock at first before pushing the stock into squeeze territory. The bears started to lose large swathes of cash and the whole thing got so out of hand, the exchange closed for three days.

While the exchange experienced some downtime, the pair came to an agreement, resulting in a INR30 million loss for Manek.

Ambani has an estimated worth of US$101.3 billion as of June 2022, making him the richest man in Asia, and the 7th richest in the world.

The Solo Short Squeeze

In the above story, Mukesh Dhirubhai Ambani was able to fight fire with fire by doing some barely legal practices to squeeze out his rival. This isn’t the first time this has happened, and won’t be the last.

One of the most famous similar examples was on the opposite side of the planet, back in 1923. The young upstart US grocery chain, Piggly Wiggly, was turning heads. It had only started in 1916 but grew like crazy, revolutionising the grocery scene. It was a unicorn, it was a disrupter, it was a business with a stupid as hell name. It was everything Silicon Valley shoots for today.

After the recession in the 1920s a couple of the franchises folded, leading to short interest in the company, which CEO Clarence Saunders took umbrage to. He swore to take revenge, saying he would “break Wall Street”, like a gaggle of Redditors. He took a $10 million loan ($150 mill in today’s money) and started buying up his own stocks. Within a week, he owned half the shares, and by March 1923 he owned 99% of shares, leaving just 1128 shares outstanding. He’d almost doubled the price of his own stock, sending it from $39 to $60. There was only one place short sellers could go hat in hand to settle, and that was to Saunders, and he was going to have his pound of flesh from them. At the time, the NYSE had no Securities and Exchange Commission, so it set its own rules. Having an outsider like Saunders come in guns blazing, a country bumpkin by Wall Street’s reckoning, just wouldn’t do. Insiders complained and an investigation was launched into his price manipulation (which wasn’t illegal at the time).

He had lent out 42,000 shares to short sellers, and now did a recall. They had 24 hours to cough up the dough. Share prices jumped even further as they scrambled to cover, sending the price from $75 to $124. It appears that Wall Street has never been well liked and newspapers around the country crowed at his win. “This Southern ‘rube’ has shown himself smarter at the Wall Street game than the New York professionals,” said one paper.

The exchange stepped in at this point to put an end to his games. Piggly Wiggly shares were suspended from being traded on the exchange completely and short sellers were given another week to buy the remaining shares Saunders didn’t own. The price dipped after all this, but Saunders was able to make a tidy profit.

Unfortunately this wasn’t enough to cover the massive loan he made to start this game and he was unable to offload any of the shares he had hoarded. Creditors came calling and within a year, he had stepped down as president of Piggly Wiggly and filed for bankruptcy, losing all his properties and large wealth he had accumulated.

The Lifestyle You’ll Love

Located in the desirable, double Grammar Zone, inner-city suburb of Parnell.

Newmarket Residences

New apartments available starting from $1,199,000 Dual keys and $1,499,000 2 bed